The Virtual Seminar on Tax Treaty was held on 24 June 2021. Representatives from BRITACOM Council Member Tax Administrations, Observers, members of the Advisory Board, and business attended the meeting. All participants and presenters contributed to this arresting and informative event.

Tax treaties serve as the legal basis for international tax cooperation, provide legal guarantee to resolve cross-border tax disputes, and enhance tax certainty globally. They boost international exchange of economies and technologies as well as the mobilization of trade, finance, and personnel, and remove barriers to economic exchange between countries (regions). Currently, COVID-19 is still wreaking havoc around the world and poses severe threats to the negotiation and signing of tax treaties between different jurisdictions. How to curb the negative impact of the pandemic with tax contribution is of great importance at this critical moment.

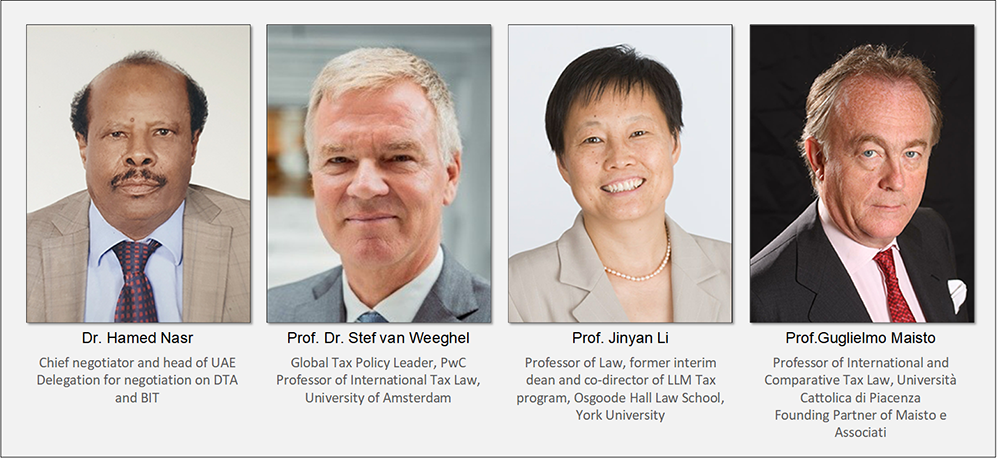

At the seminar, Dr. Hamed Nasr from the Ministry of Finance of the United Arab Emirates introduced their treaty network and experience in successfully signing and enforcing tax treaty during COVID-19. Prof. Dr. Stef van Weeghel, Global Tax Policy Leader of PwC and Professor of International Tax Law, University of Amsterdam, reflected on Tax Treaties between BRI Countries. Prof. Jinyan Li, Osgoode Hall Law School, York University, briefed participants on tax treaties between China and BRI jurisdictions, COVID-19 and tax treaties, and tax treaties beyond COVID-19. Guglielmo Maisto, member of the BRITACOM Advisory Board, Professor of International and Comparative Tax Law of Università Cattolica di Piacenza, and Founding Partner of Maisto e Associati, presented insights in improving and expanding tax treaty rules on international transport and proffered proposals on future improvement to address treaty-related issues. Mr. Li Qiaolang, representative of STA, China, introduced measures that Chinese taxation department has taken in response to COVID-19 and positive contributions that those measures have made, and shared experiences in treaty negotiation and implementation of agreements during the Pandemic.

Participants were attentive at the conference and had interactive communication with speakers on key topics and issues.

The BRITACOM will organize follow-up seminars to facilitate communication between Member Tax Administrations and observers, forge consensus, and enhance cooperation to build a growth-friendly tax environment.

(see details about the virtual seminar on tax treaty)