Page 25 - BRITACEG

P. 25

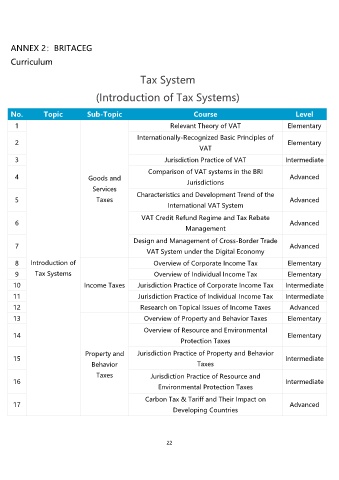

ANNEX 2:BRITACEG

Curriculum

Tax System

(Introduction of Tax Systems)

No. Topic Sub-Topic Course Level

1 Relevant Theory of VAT Elementary

Internationally-Recognized Basic Principles of

2 Elementary

VAT

3 Jurisdiction Practice of VAT Intermediate

Comparison of VAT systems in the BRI

4 Goods and Advanced

Jurisdictions

Services

Characteristics and Development Trend of the

5 Taxes Advanced

International VAT System

VAT Credit Refund Regime and Tax Rebate

6 Advanced

Management

Design and Management of Cross-Border Trade

7 Advanced

VAT System under the Digital Economy

8 Introduction of Overview of Corporate Income Tax Elementary

9 Tax Systems Overview of Individual Income Tax Elementary

10 Income Taxes Jurisdiction Practice of Corporate Income Tax Intermediate

11 Jurisdiction Practice of Individual Income Tax Intermediate

12 Research on Topical Issues of Income Taxes Advanced

13 Overview of Property and Behavior Taxes Elementary

Overview of Resource and Environmental

14 Elementary

Protection Taxes

Property and Jurisdiction Practice of Property and Behavior

15 Intermediate

Behavior Taxes

Taxes Jurisdiction Practice of Resource and

16 Intermediate

Environmental Protection Taxes

Carbon Tax & Tariff and Their Impact on

17 Advanced

Developing Countries

22