Page 26 - BRITACEG

P. 26

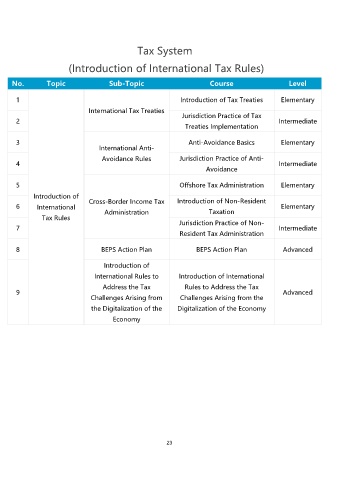

Tax System

(Introduction of International Tax Rules)

No. Topic Sub-Topic Course Level

1 Introduction of Tax Treaties Elementary

International Tax Treaties

Jurisdiction Practice of Tax

2 Intermediate

Treaties Implementation

3 Anti-Avoidance Basics Elementary

International Anti-

Avoidance Rules Jurisdiction Practice of Anti-

4 Intermediate

Avoidance

5 Offshore Tax Administration Elementary

Introduction of

Cross-Border Income Tax Introduction of Non-Resident

6 International Elementary

Administration Taxation

Tax Rules Jurisdiction Practice of Non-

7 Intermediate

Resident Tax Administration

8 BEPS Action Plan BEPS Action Plan Advanced

Introduction of

International Rules to Introduction of International

Address the Tax Rules to Address the Tax

9 Advanced

Challenges Arising from Challenges Arising from the

the Digitalization of the Digitalization of the Economy

Economy

23