Page 31 - BRITACEG

P. 31

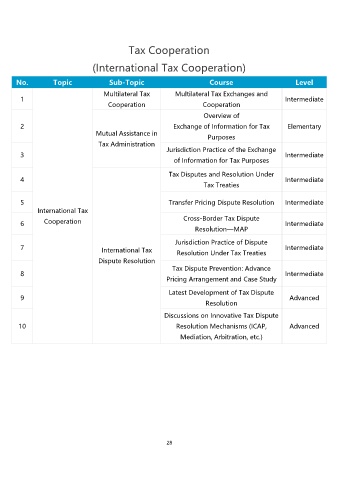

Tax Cooperation

(International Tax Cooperation)

No. Topic Sub-Topic Course Level

Multilateral Tax Multilateral Tax Exchanges and

1 Intermediate

Cooperation Cooperation

Overview of

2 Exchange of Information for Tax Elementary

Mutual Assistance in

Purposes

Tax Administration

Jurisdiction Practice of the Exchange

3 Intermediate

of Information for Tax Purposes

Tax Disputes and Resolution Under

4 Intermediate

Tax Treaties

5 Transfer Pricing Dispute Resolution Intermediate

International Tax

6 Cooperation Cross-Border Tax Dispute Intermediate

Resolution—MAP

Jurisdiction Practice of Dispute

7 International Tax Resolution Under Tax Treaties Intermediate

Dispute Resolution

Tax Dispute Prevention: Advance

8 Intermediate

Pricing Arrangement and Case Study

Latest Development of Tax Dispute

9 Advanced

Resolution

Discussions on Innovative Tax Dispute

10 Resolution Mechanisms (ICAP, Advanced

Mediation, Arbitration, etc.)

28